- M&A Mindset

- Posts

- Deal Language Differences - Same Words. Different Meanings.

Deal Language Differences - Same Words. Different Meanings.

Plus: M&A in 2026: Top 5 Things To Keep in Mind for Small Business

Quick M&A Insights, Infographics, & Interesting Info Every Week!

Welcome to the M&A Mindset!

This Week:

Happy New Year! This week we are breaking down how a seller and buyer use the same terms when talking about a deal but they have very different meanings. Plus, as 2026 gets underway, we look at some top things to keep in mind if you are a small business owner considering selling your company this year. And, as always, curated articles, learning resources, fun M&A merch, and something to get you to lighten up a bit...

Let's dive in.

- Derek

Table of Contents

INTERESTING INFOGRAPHIC

Each week, I feature a visually engaging infographic that distills a key M&A subject area into an easy-to-digest format. These quick reference guides aim to deliver clarity, insight, and practical understanding at a glance.

Deal Language Differences

M&A TOPIC BRIEFING

In this section, I provide a clear, concise overview of a specific topic, trend, or concept within the realm of M&A. The goal is to educate, inform, and spark discussions on relevant subjects, helping you deepen your knowledge and better navigate the complexities of M&A more confidently.

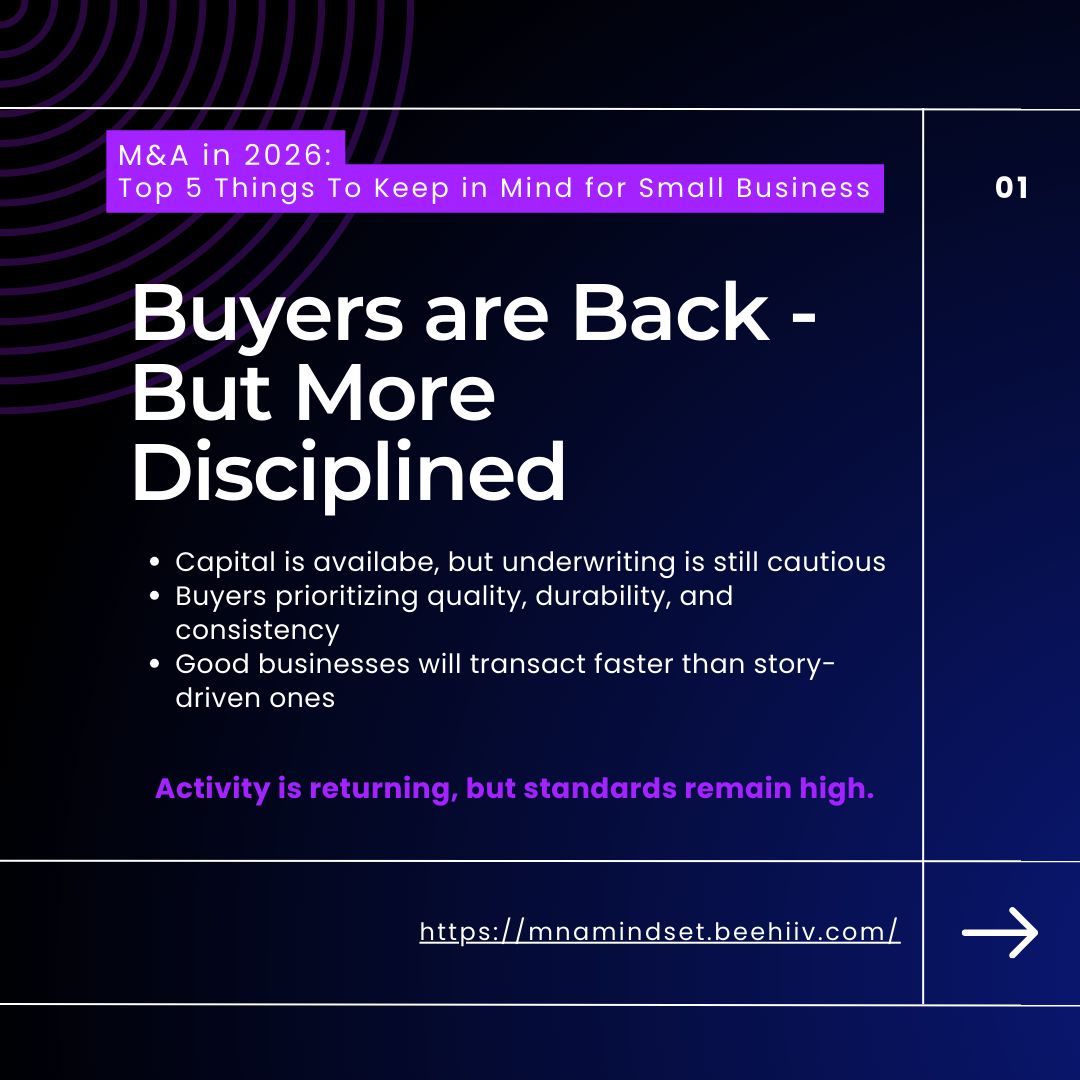

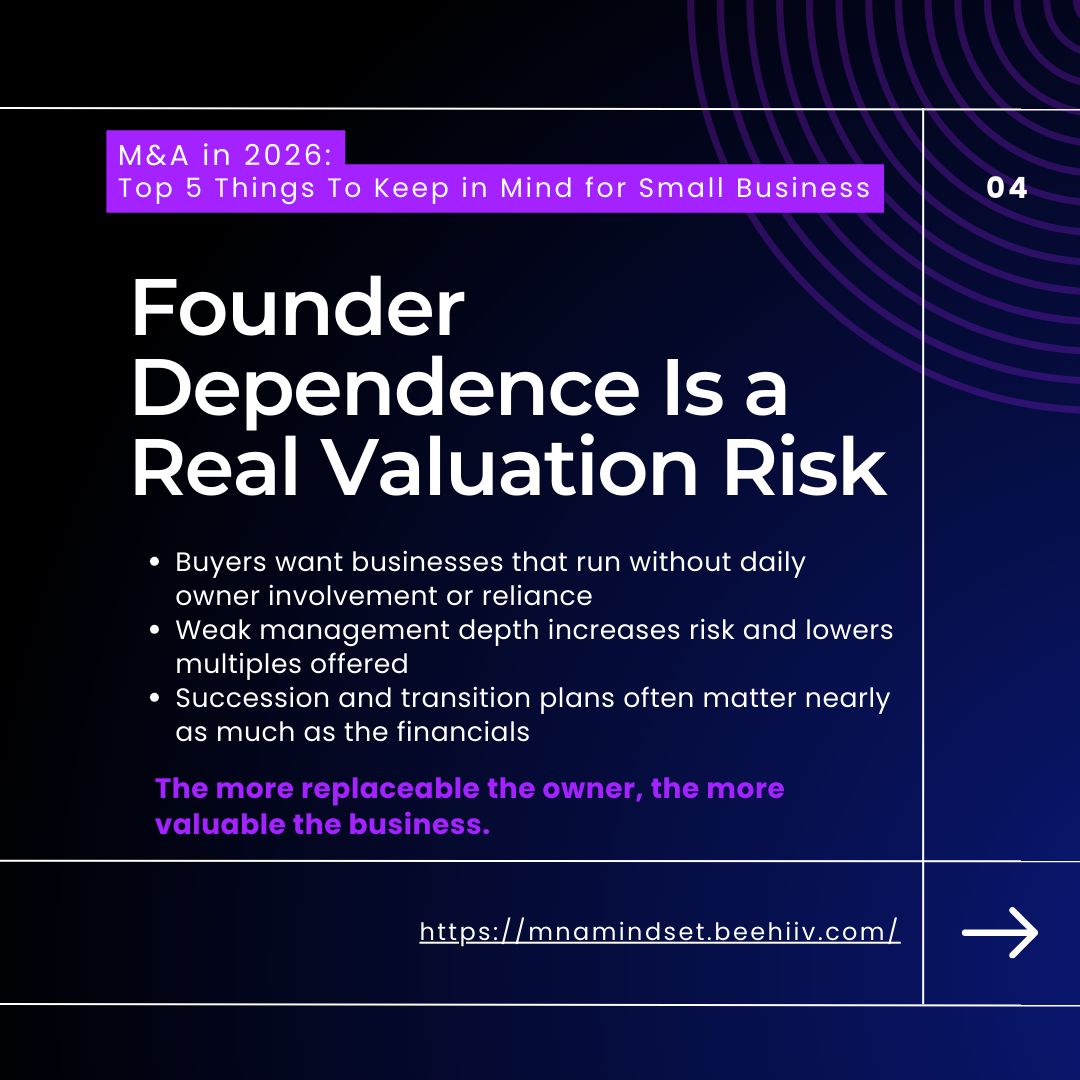

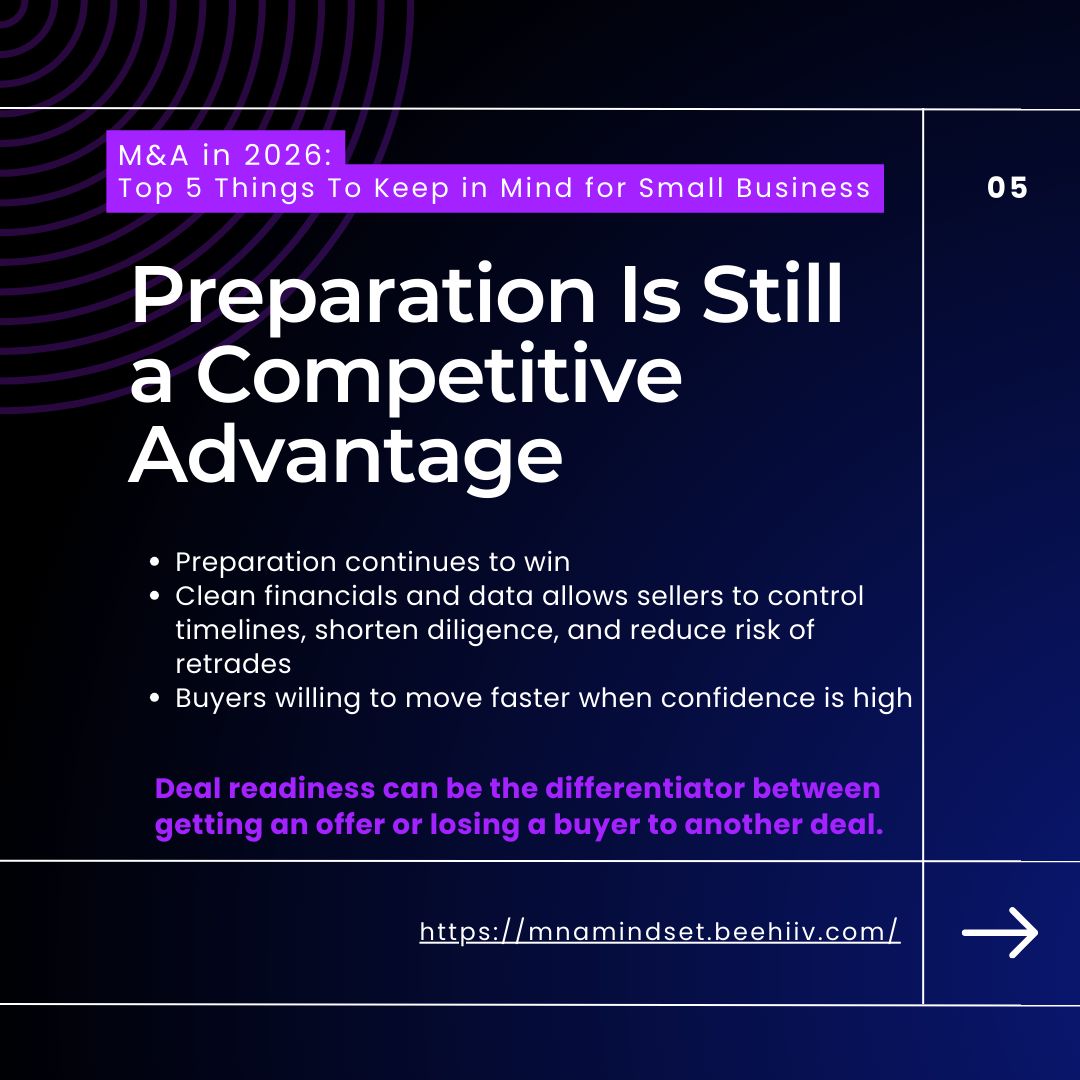

M&A in 2026: Top 5 Things To Keep in Mind for Small Business

Know what works before you spend.

Discover what drives conversions for your competitors with Gethookd. Access 38M+ proven Facebook ads and use AI to create high-performing campaigns in minutes — not days.

ARTICLES OF INTEREST

Goldman Sachs 2026 Global M&A Outlook - Goldman Sachs projects another strong year for M&A in 2026, driven by abundant public and private capital, the strategic impact of AI, and companies’ ambition to reposition and scale through transformative deals as valuations normalize and flexible financing expands

M&A Professionals Predict a Continued Market Upswing in 2026 - Dealmakers surveyed by KPMG expect both higher deal volume and better quality in 2026, citing market expansion, strategic growth, and generative AI efficiencies as key drivers of optimism

8 Factors That Will Drive More M&A in 2026 - Shifting macro conditions like abundant dry powder, long private equity holds, better alignment on valuations, stable credit, and strategic buyer urgency are set to boost M&A activity in 2026.

Where Private Equity is Betting Big in 2026 - Private equity is targeting resilient, high-growth sectors in 2026—particularly health care and infrastructure—attracted by strong fundamentals, favorable demographics, and predictable cash flows.

A Beloved Cupcake Company is Shutting Down - And Fans are Blaming Private Equity - Sprinkles Cupcakes, famed for its viral “Cupcake ATM” and beloved nationwide brand, is closing all of its stores after 20 years of operation, a move that has drawn backlash from fans and employees.

EDUCATIONAL RESOURCES

Master Financial Modeling from Elite Practitioners

6 jam-packed courses with countless cases and 30+ exercises to help you learn financial modeling. Each course is designed to guide you step-by-step in your journey to develop elite modeling skills. Click Here!

FROM THE BENCHMARK BLOG

My firm, Benchmark International, a global, award-winning sell-side M&A company, has a ton of great resources that help anyone considering selling or buying a business get more educated on all aspects of the process. Below is just one helpful article. Check out Benchmark International for many more useful articles, news, and resources.

INDUSTRY ASSOCIATIONS

Trade Associations in the M&A Industry

LIGHTEN UP!

In the fast-paced world of M&A, we can sometimes take things (and ourselves) a bit too seriously, so it’s good to remember to enjoy a lighter moment now and then.

Buffett Makes a Bold 100-Year Bet on Berkshire as He Steps Aside

M&A MERCH

Here’s a find for us finance folks to grab some M&A-inspired swag. Stuff for those of us that speak fluent EBITDA. If you find others that have great deal-themed gear, send them this way so we can let everyone know. Enjoy!

Thanks for reading this week's edition!

Share the M&A Mindset with colleagues who'd benefit from straightforward M&A insights.

Got a topic you want covered or feedback to share? Just hit reply—I read everything.

Stay Curious,

Derek Avdul

New to the M&A Mindset? This weekly newsletter cuts through the noise with concise insights, infographics, and resources on middle-market M&A—trusted by 4,000+ deal professionals, business owners, and investors. Whether you're planning a transaction, building your expertise, or just fascinated by deals, you'll find something valuable here every week.

Questions or suggestions? [email protected]

Reply