- M&A Mindset

- Posts

- EBITDA Addbacks: Credibility Matters

EBITDA Addbacks: Credibility Matters

Plus: Why Buyers Say "No"

Quick M&A Insights, Infographics, & Interesting Info Every Week!

Welcome to the M&A Mindset!

This Week:

This week we are breaking down EBITDA addbacks and what matters most to buyers when looking at addbacks. Also, what are the reasons that buyers say “no” to a deal. And, as always, curated articles, learning resources, fun M&A merch, and something to get you to lighten up a bit...

Let's dive in.

- Derek

Table of Contents

INTERESTING INFOGRAPHIC

Each week, I feature a visually engaging infographic that distills a key M&A subject area into an easy-to-digest format. These quick reference guides aim to deliver clarity, insight, and practical understanding at a glance.

EBITDA Addbacks: Credibility Matters

M&A TOPIC BRIEFING

In this section, I provide a clear, concise overview of a specific topic, trend, or concept within the realm of M&A. The goal is to educate, inform, and spark discussions on relevant subjects, helping you deepen your knowledge and better navigate the complexities of M&A more confidently.

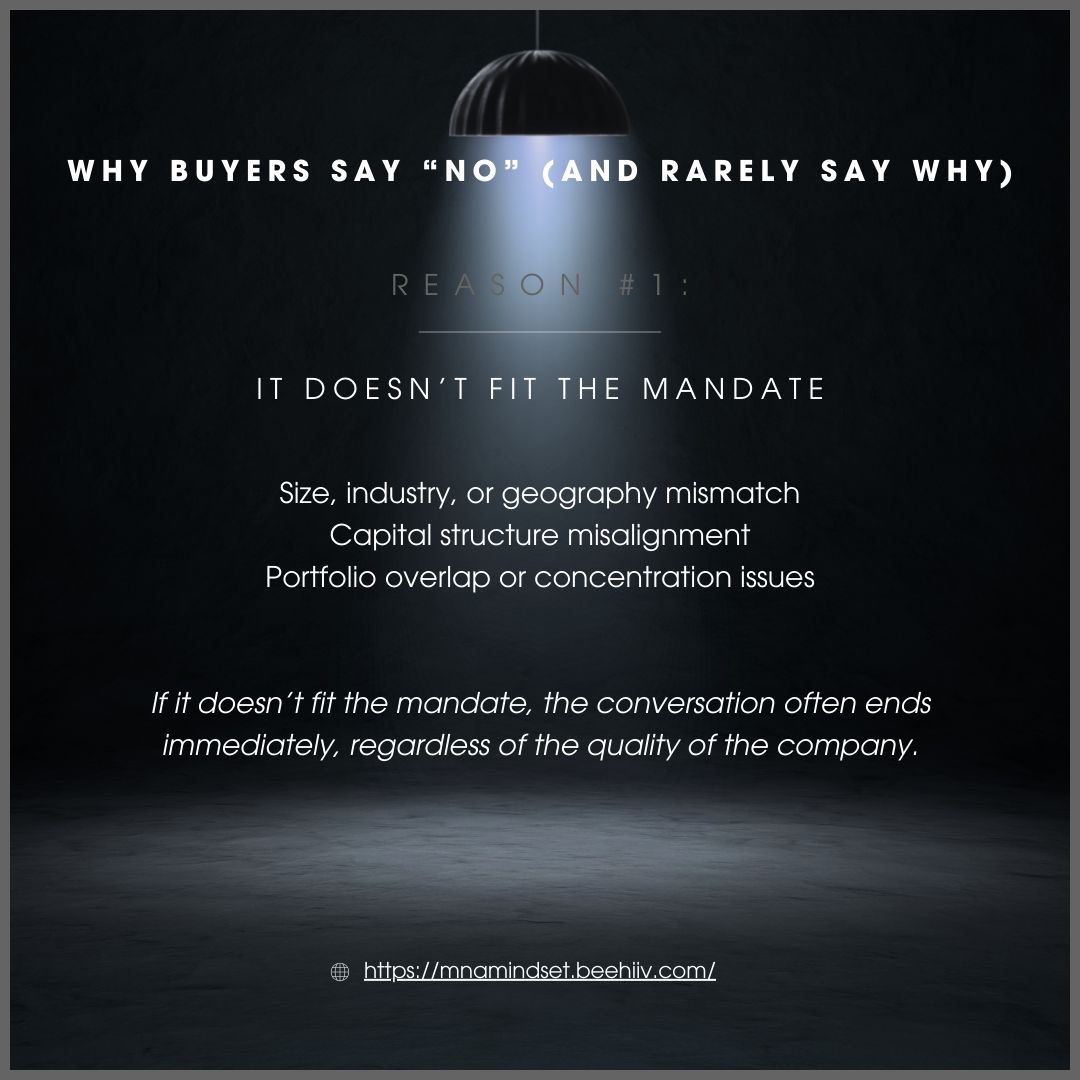

Why Buyers Say “No” (And Rarely Say Why)

AI in HR? It’s happening now.

Deel's free 2026 trends report cuts through all the hype and lays out what HR teams can really expect in 2026. You’ll learn about the shifts happening now, the skill gaps you can't ignore, and resilience strategies that aren't just buzzwords. Plus you’ll get a practical toolkit that helps you implement it all without another costly and time-consuming transformation project.

ARTICLES OF INTEREST

JPMorgan Global Head Says Rising Risks To Drive Surge In Deals - Dealmakers are poised for a strong 2026 M&A year with a record pipeline of deals, as companies pursue larger mergers and acquisitions to build scale and better withstand rising economic and geopolitical risks.

M&A Lawyers See "Bulging Pipeline" For 2026 After Deal-Crazed Year - Lawyers at major firms say 2026 looks set for another very active M&A market after a near-record 2025 that saw global transaction values surge and an unprecedented number of mega-deals, and they expect continued strong demand—especially in the mid-market and private equity space.

Private Equity Firms Expected To Unleash Middle-Market M&A Deals - Private equity firms and middle-market executives are increasingly confident 2026 will bring a rise in middle-market M&A activity, with a majority expecting deal volume to grow as sponsors become more willing to transact—driven by optimism around economic growth, lower interest rates, attractive valuations, and strategic interest in sectors like tech and AI.

Why Mergers & Acquisitions Aren't Just For Big Corporates Anymore - M&A is no longer just the domain of giant corporations — technology, private capital, and accessible deal platforms have democratized deal-making so that startups, small businesses, and solo entrepreneurs can use acquisitions as a strategic growth tool, with micro-private equity and creative financing making smaller deals both practical and attractive.

ETA and Search Funds as Viable M&A Models - Entrepreneurship Through Acquisition (ETA) and search funds are gaining attention as an M&A model, where entrepreneurs raise capital to find, acquire, and run established small-to-medium businesses—offering a potentially faster and lower-risk path to ownership than starting a business from scratch, though with notable challenges and mixed success rates.

EDUCATIONAL RESOURCES

Master Financial Modeling from Elite Practitioners

6 jam-packed courses with countless cases and 30+ exercises to help you learn financial modeling. Each course is designed to guide you step-by-step in your journey to develop elite modeling skills. Click Here!

FROM THE BENCHMARK BLOG

My firm, Benchmark International, a global, award-winning sell-side M&A company, has a ton of great resources that help anyone considering selling or buying a business get more educated on all aspects of the process. Below is just one helpful article. Check out Benchmark International for many more useful articles, news, and resources.

INDUSTRY ASSOCIATIONS

Trade Associations in the M&A Industry

LIGHTEN UP!

In the fast-paced world of M&A, we can sometimes take things (and ourselves) a bit too seriously, so it’s good to remember to enjoy a lighter moment now and then.

Best Finance Podcasts for 2026

M&A MERCH

Here’s a find for us finance folks to grab some M&A-inspired swag. Stuff for those of us that speak fluent EBITDA. If you find others that have great deal-themed gear, send them this way so we can let everyone know. Enjoy!

Thanks for reading this week's edition!

Share the M&A Mindset with colleagues who'd benefit from straightforward M&A insights.

Got a topic you want covered or feedback to share? Just hit reply—I read everything.

Stay Curious,

Derek Avdul

New to the M&A Mindset? This weekly newsletter cuts through the noise with concise insights, infographics, and resources on middle-market M&A—trusted by 4,000+ deal professionals, business owners, and investors. Whether you're planning a transaction, building your expertise, or just fascinated by deals, you'll find something valuable here every week.

Questions or suggestions? [email protected]

Reply