- M&A Mindset

- Posts

- EBITDA to Equity Value: What Sellers Get Paid

EBITDA to Equity Value: What Sellers Get Paid

Plus: Why "Just Testing The Market" Doesn't Work

Quick M&A Insights, Infographics, & Interesting Info Every Week!

Welcome to the M&A Mindset!

This Week:

We're breaking down how a seller’s EBITDA translates into money in his pocket. Plus, we look at why just testing the market as a seller is a waste of everyone’s time. And, as always, curated articles, learning resources, fun M&A merch, and something to get you to lighten up a bit...

Let's dive in.

- Derek

Table of Contents

INTERESTING INFOGRAPHIC

Each week, I feature a visually engaging infographic that distills a key M&A subject area into an easy-to-digest format. These quick reference guides aim to deliver clarity, insight, and practical understanding at a glance.

EBITDA to Equity Value: What Sellers Get Paid

M&A TOPIC BRIEFING

In this section, I provide a clear, concise overview of a specific topic, trend, or concept within the realm of M&A. The goal is to educate, inform, and spark discussions on relevant subjects, helping you deepen your knowledge and better navigate the complexities of M&A more confidently.

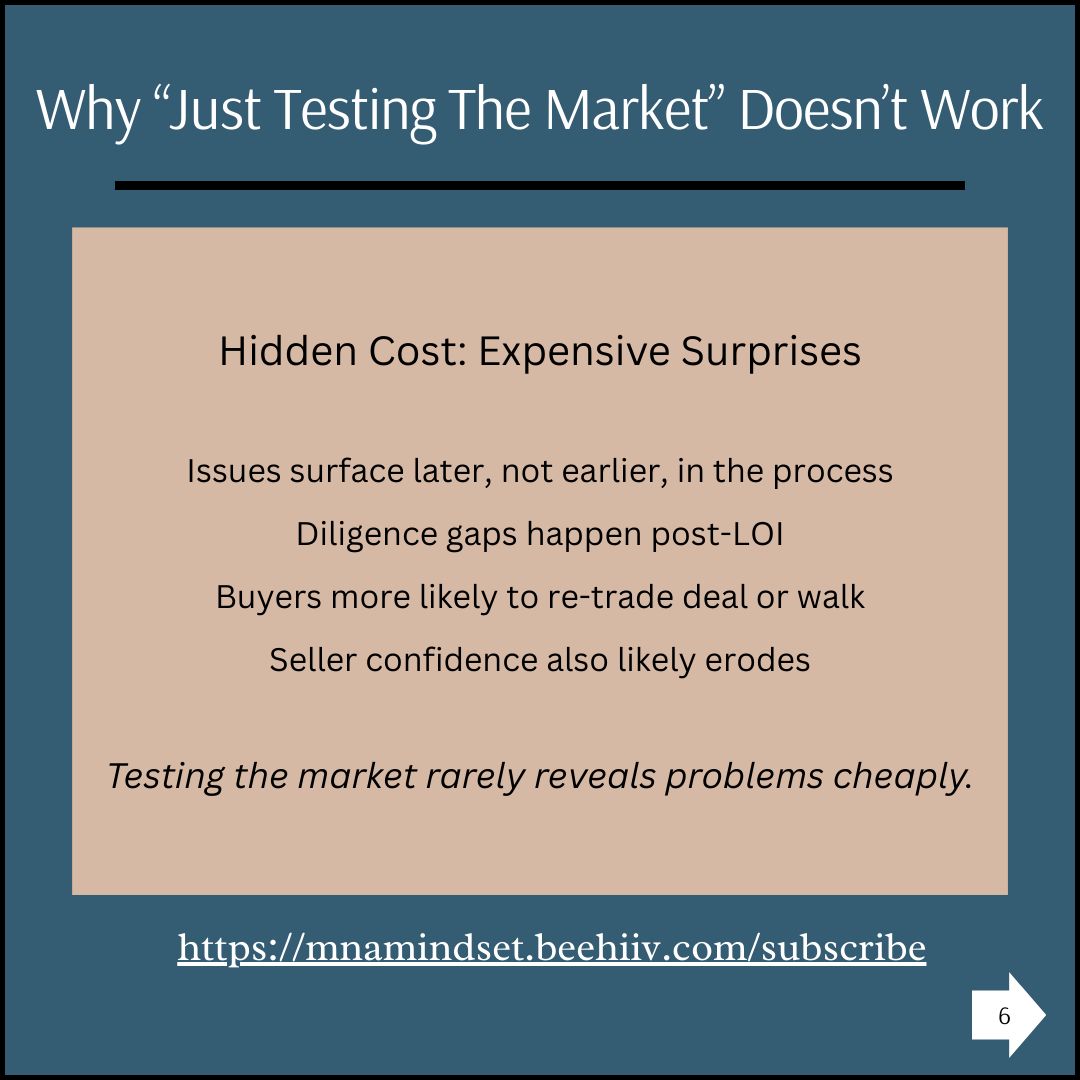

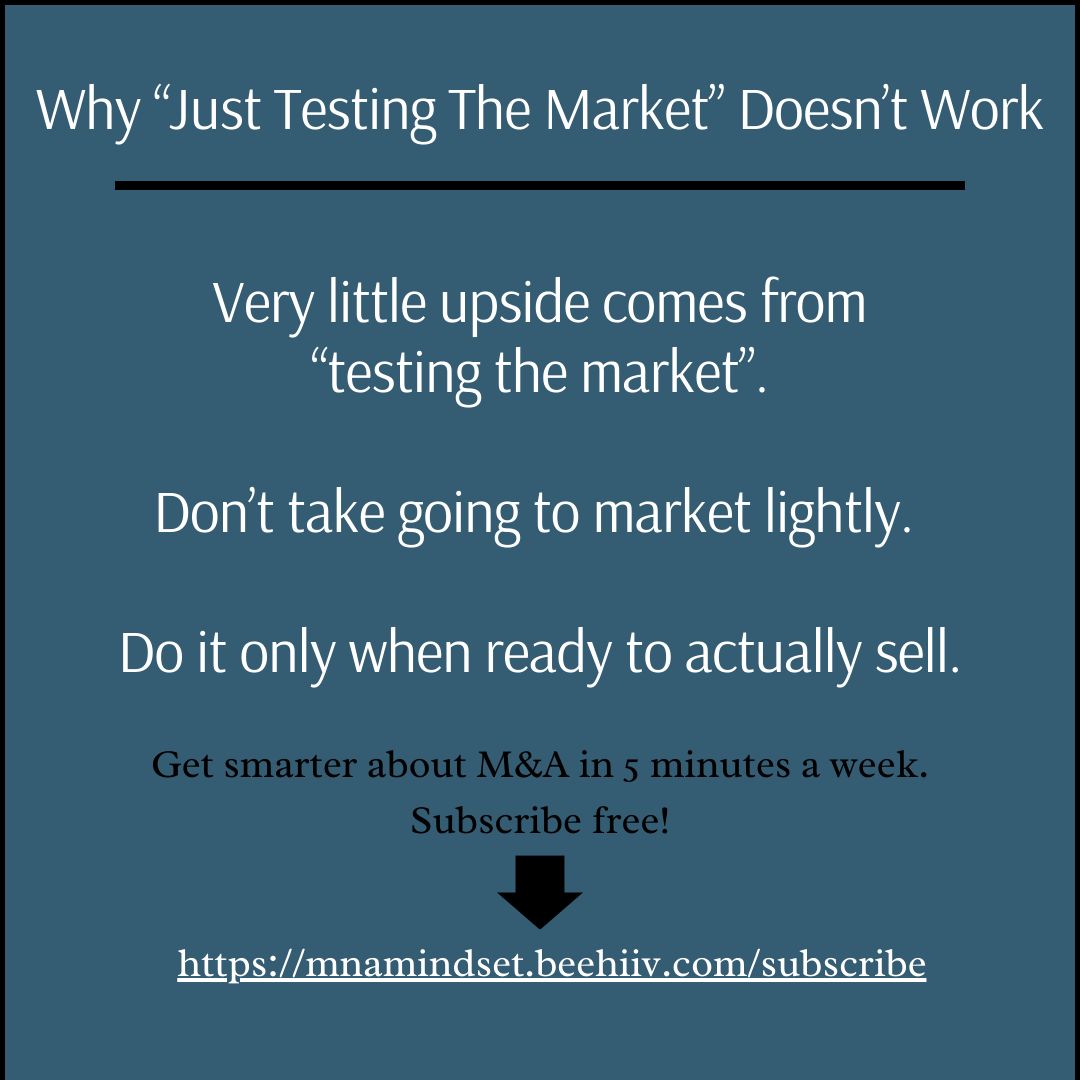

Why “Just Testing The Market” Doesn’t Work

Investors see ANOTHER return on Masterworks (!!!)

That’s 3 sales this quarter. 26 sales total.

And the performance?

14.6%, 17.6%, and 17.8% → The three most representative annualized net returns.

(See all 26 at Masterworks.com)

Masterworks is the biggest platform for investing in an asset class that hasn’t moved in lockstep with the S&P 500 since ‘95.

In fact, the market segment they target outpaced the S&P overall in that time frame.*

Not private equity or real estate… It’s contemporary and post war art. Crazy, right?

Masterworks investors are typically high net worth, but the point is that you don’t need to be a capital-B BILLIONAIRE to invest in high-caliber art anymore.

Banksy. Basquiat. Picasso and more.

80+ of the world’s most attractive artists have been featured.

511+ artworks offered

$67.5mm paid out as of December 2025

$2.3mm+ average offering size

Looking to update your investment portfolio before 2026?

*Masterworks data. Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

ARTICLES OF INTEREST

This Could Be The Biggest Challenge For Small Business Owners in 2026 - Small business owners say the biggest challenge heading into 2026 will be finding and hiring qualified workers, with labor shortages and lack of applicants outpacing concerns like inflation and taxes, potentially limiting growth and stability next year.

Old-School Playbook Finds New Life in Middle-Market Private Equity - Middle-market private equity firms are finding renewed opportunity by returning to traditional strategies—buying and building founder-led, lower middle-market companies that larger funds overlook and then exiting them at attractive multiples.

The Rise of Continuation Vehicles and Other Trends in the Lower Midmarket - Podcast and transcript in which TPG Twin Brook Capital Partners discusses key lower middle-market M&A trends, especially the growing use of continuation vehicles as a flexible tool for sponsors and investors, alongside evolving lending structures and other market dynamics.

Why Manufacturing Execs Are Bullish on 2026 - Manufacturing executives are optimistic about growth and M&A in 2026, citing strong expected sales, strategic investments (like AI, automation, and ERP systems), and resilient deal activity—especially add-on and carve-out transactions—despite ongoing cost, supply chain, and labor challenges.

Private Equity Firms Prepare for Massive Portfolio Clearout in 2026 - Private equity firms are gearing up for a major portfolio clearout in 2026 as they look to offload a backlog of aging investments that have frustrated investors and hindered fundraising, with a resurgence in exits—especially IPOs—expected to drive more sales next year.

EDUCATIONAL RESOURCES

Master Financial Modeling from Elite Practitioners

6 jam-packed courses with countless cases and 30+ exercises to help you learn financial modeling. Each course is designed to guide you step-by-step in your journey to develop elite modeling skills. Click Here!

FROM THE BENCHMARK BLOG

My firm, Benchmark International, a global, award-winning sell-side M&A company, has a ton of great resources that help anyone considering selling or buying a business get more educated on all aspects of the process. Below is just one helpful article. Check out Benchmark International for many more useful articles, news, and resources.

INDUSTRY ASSOCIATIONS

Trade Associations in the M&A Industry

LIGHTEN UP!

In the fast-paced world of M&A, we can sometimes take things (and ourselves) a bit too seriously, so it’s good to remember to enjoy a lighter moment now and then.

Warren Buffett’s 31 Funniest Quotes

M&A MERCH

Here’s a find for us finance folks to grab some M&A-inspired swag. Stuff for those of us that speak fluent EBITDA. If you find others that have great deal-themed gear, send them this way so we can let everyone know. Enjoy!

Thanks for reading this week's edition!

Share the M&A Mindset with colleagues who'd benefit from straightforward M&A insights.

Got a topic you want covered or feedback to share? Just hit reply—I read everything.

Stay Curious,

Derek Avdul

New to the M&A Mindset? This weekly newsletter cuts through the noise with concise insights, infographics, and resources on middle-market M&A—trusted by 4,000+ deal professionals, business owners, and investors. Whether you're planning a transaction, building your expertise, or just fascinated by deals, you'll find something valuable here every week.

Questions or suggestions? [email protected]

Reply