- M&A Mindset

- Posts

- The Valuation Gap: Why Sellers Think It's Worth More Than Buyers

The Valuation Gap: Why Sellers Think It's Worth More Than Buyers

Plus: Why Experience Matters More Than Price in M&A

Quick M&A Insights, Infographics, & Interesting Info Every Week!

Welcome to the M&A Mindset!

This Week:

This week we are breaking down why sellers always think their company is worth more than buyers — there is a reason. Plus, put simply, get an M&A advisor (i.e., why experience maters more than price in a deal). And, as always, curated articles, learning resources, fun M&A merch, and something to get you to lighten up a bit...

Let's dive in.

- Derek

Table of Contents

INTERESTING INFOGRAPHIC

Each week, I feature a visually engaging infographic that distills a key M&A subject area into an easy-to-digest format. These quick reference guides aim to deliver clarity, insight, and practical understanding at a glance.

The Valuation Gap: Why Sellers Think It’s Worth More Than Buyers

M&A TOPIC BRIEFING

In this section, I provide a clear, concise overview of a specific topic, trend, or concept within the realm of M&A. The goal is to educate, inform, and spark discussions on relevant subjects, helping you deepen your knowledge and better navigate the complexities of M&A more confidently.

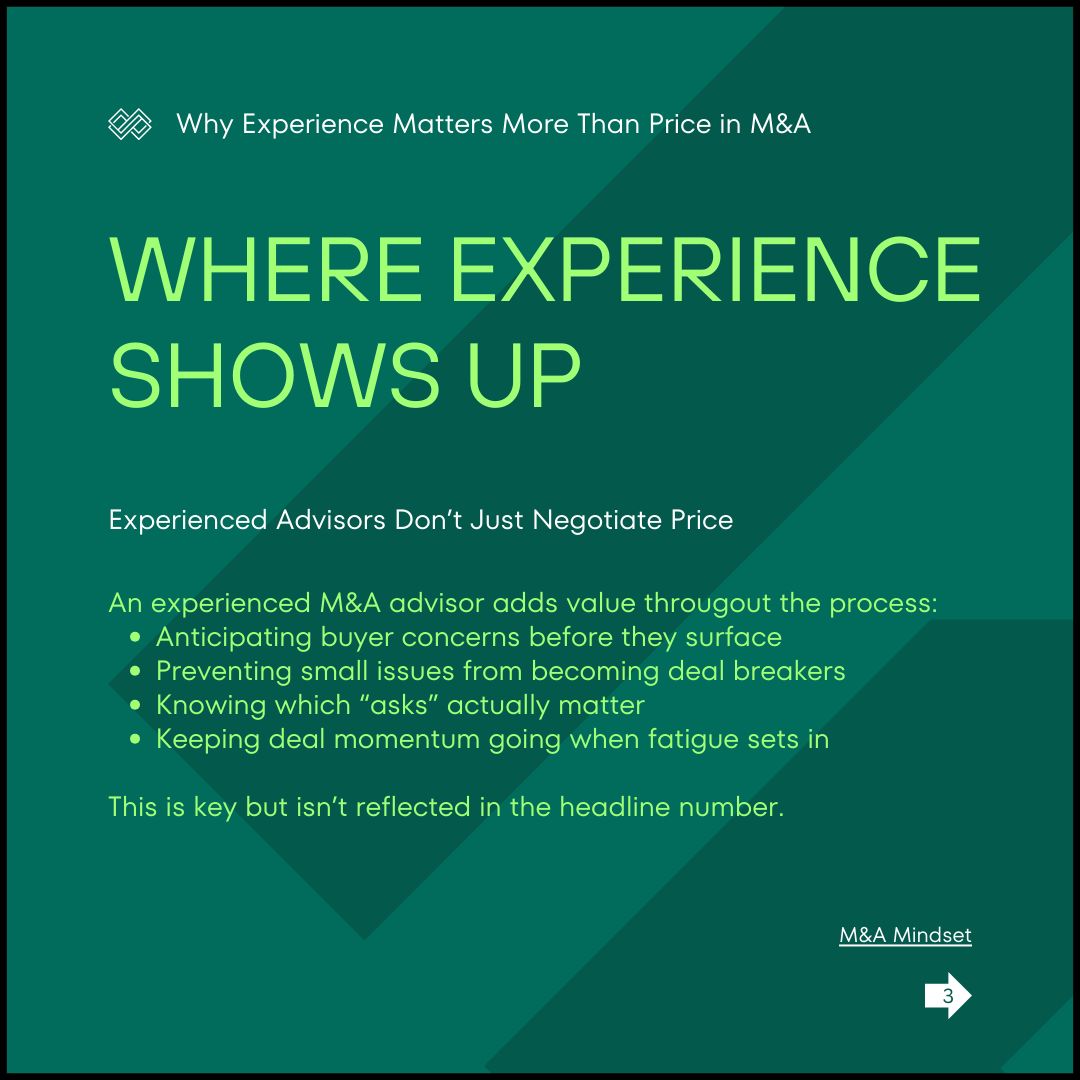

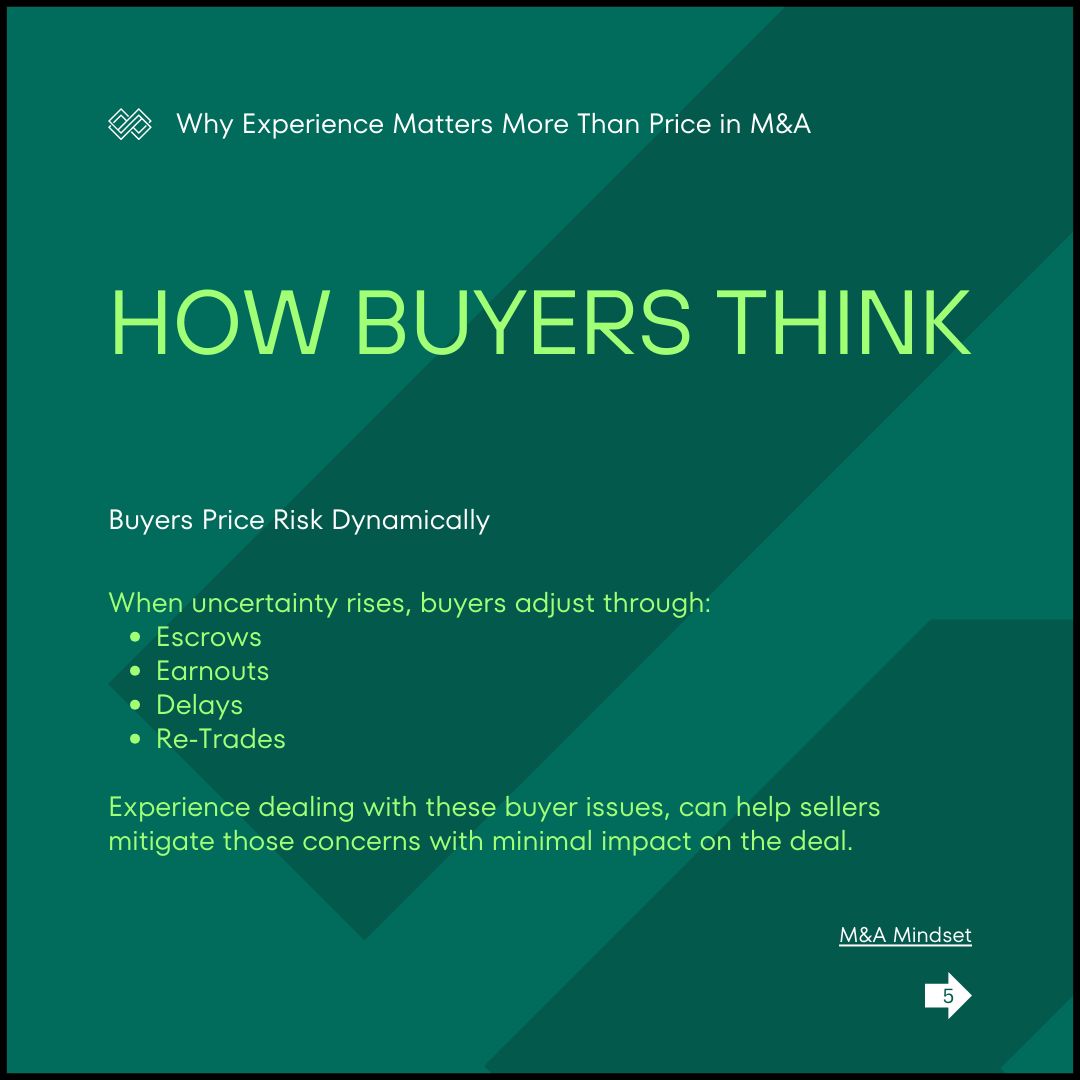

Why Experience Matters More Than Price in M&A

200+ AI Side Hustles to Start Right Now

While you were debating if AI would take your job, other people started using it to print money. Seriously.

That's not hyperbole. People are literally using ChatGPT to write Etsy descriptions that convert 3x better. Claude to build entire SaaS products without coding. Midjourney to create designs clients pay thousands for.

The Hustle found 200+ ways regular humans are turning AI into income. Subscribe to The Hustle for the full guide and unlock daily business intel that's actually interesting.

ARTICLES OF INTEREST

Deal Fever Returns: 2026 Looks Hot for M&A - A new survey reveals a sharp rise in U.S. CEOs planning M&A deals—jumping to around 62%—as confidence and strategic dealmaking intentions surge, signaling a stronger and more proactive M&A market in 2026.

Why This $21 Million Bet on an Investment Bank Signals Confidence in M&A - A fund’s significant purchase of Moelis & Company shares suggests investor confidence in mergers and acquisitions activity.

How AI Can Help Shape M&A Success - AI is becoming a strategic force in M&A, helping teams automate due diligence, uncover risks and synergies faster, and optimize integration efforts across IT, culture, compliance and security.

The Road to Retirement: How to Succeed in Selling Your Business - Business owners are urged to start transition planning early—focusing on succession, clean financials, tax strategies, and having a clear post-sale personal plan—to avoid regrets and maximize value when selling.

Private Equity Investments Boost Small & Mid-Market Businesses - A new American Investment Council report shows private equity invested $654.1 billion in over 21,000 small and mid-sized U.S. businesses, helping fill financing gaps, support growth, create jobs, and smooth founder transitions.

EDUCATIONAL RESOURCES

Master Financial Modeling from Elite Practitioners

6 jam-packed courses with countless cases and 30+ exercises to help you learn financial modeling. Each course is designed to guide you step-by-step in your journey to develop elite modeling skills. Click Here!

FROM THE BENCHMARK BLOG

My firm, Benchmark International, a global, award-winning sell-side M&A company, has a ton of great resources that help anyone considering selling or buying a business get more educated on all aspects of the process. Below is just one helpful article. Check out Benchmark International for many more useful articles, news, and resources.

INDUSTRY ASSOCIATIONS

Trade Associations in the M&A Industry

FRIENDS OF THE M&A MINDSET

From time to time, we’ll highlight newsletters and podcasts we genuinely read, listen to, and respect across M&A, PE, and the broader deal ecosystem.

No paid placements. No mass promotions. Just thoughtful, high-quality content that complements the M&A Mindset.

Here’s a few newsletters that I’ve signed up for and found interesting. Thought you might enjoy checking them out.

Have something to suggest that we should know about? Reach out.

LIGHTEN UP!

In the fast-paced world of M&A, we can sometimes take things (and ourselves) a bit too seriously, so it’s good to remember to enjoy a lighter moment now and then.

Super Bowl 2026 Ticket Prices Are Dropping. What Do They Cost Now?

M&A MERCH

Here’s a find for us finance folks to grab some M&A-inspired swag. Stuff for those of us that speak fluent EBITDA. If you find others that have great deal-themed gear, send them this way so we can let everyone know. Enjoy!

RATE THIS WEEK'S ISSUEWhat did you think? |

Thanks for reading this week's edition!

Share the M&A Mindset with colleagues who'd benefit from straightforward M&A insights.

Got a topic you want covered or feedback to share? Just hit reply—I read everything.

Stay Curious,

Derek Avdul

New to the M&A Mindset? This weekly newsletter cuts through the noise with concise insights, infographics, and resources on middle-market M&A—trusted by 5,000+ deal professionals, business owners, and investors. Whether you're planning a transaction, building your expertise, or just fascinated by deals, you'll find something valuable here every week.

Questions or suggestions? [email protected]

Reply