- M&A Mindset

- Posts

- What Buyers Mean by "Quality"

What Buyers Mean by "Quality"

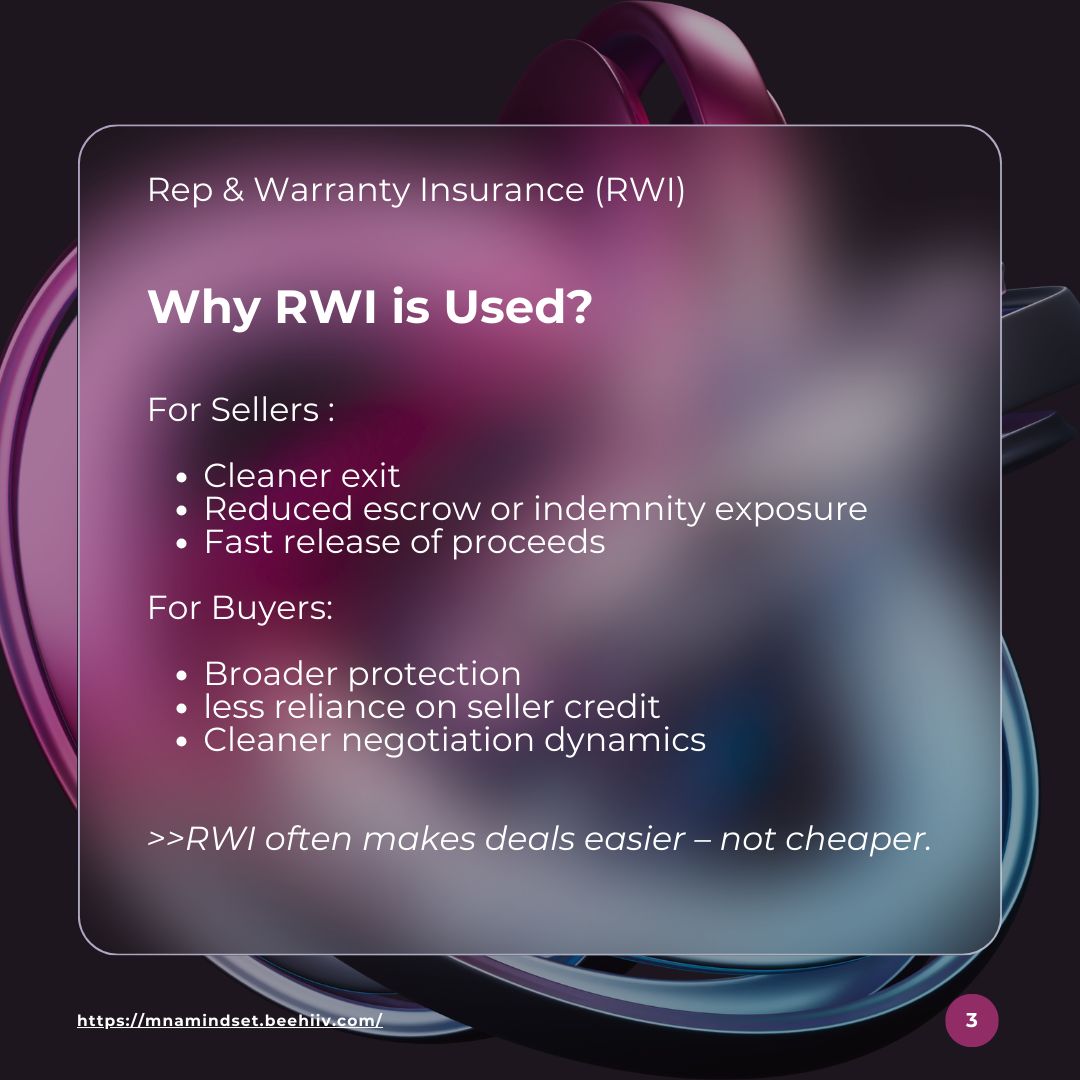

Plus: Rep & Warranty Insurance (RWI): Why, When, & How

Quick M&A Insights, Infographics, & Interesting Info Every Week!

Welcome to the M&A Mindset!

This Week:

This week we are breaking down what buyers actually mean when they say “Quality” is six key categories. Plus, what is RWI and when is it used in deals? And, as always, curated articles, learning resources, fun M&A merch, and something to get you to lighten up a bit...

Let's dive in.

- Derek

Table of Contents

INTERESTING INFOGRAPHIC

Each week, I feature a visually engaging infographic that distills a key M&A subject area into an easy-to-digest format. These quick reference guides aim to deliver clarity, insight, and practical understanding at a glance.

What Buyers Mean by “Quality”

M&A TOPIC BRIEFING

In this section, I provide a clear, concise overview of a specific topic, trend, or concept within the realm of M&A. The goal is to educate, inform, and spark discussions on relevant subjects, helping you deepen your knowledge and better navigate the complexities of M&A more confidently.

Rep & Warranty Insurance (RWI): Why, When, & How

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

ARTICLES OF INTEREST

U.S. M&A Market Set to Broaden as Confidence Surges - A new survey shows optimism among middle market companies and private equity leaders at a six-year high, suggesting 2026 M&A activity will broaden beyond megadeals as economic clarity, strong valuations, and confidence fuel increased dealmaking.

The Quiet Revolution Making Business Ownership More Attainable Than Ever - New models like fundless sponsors and fractional funds are lowering barriers to business ownership by allowing deal-by-deal investing and smaller capitalization, opening the market to operators and investors who lacked access to traditional private equity structures.

Ex-Corporate Execs Launch Independent Sponsor as Deal Flow Migrates Down Market - Veteran dealmakers have launched an independent sponsor platform to pursue lower mid-market deals in sectors like business services and specialty industrials, reflecting broader momentum for deal-by-deal investing outside traditional private equity funds.

Want to Sell Y our Business Someday? Do These 4 Things Now - Founders are advised to prepare early for a future sale by building a brand and systems that don’t revolve around the owner, keeping clean financials, optimizing for profit, and ensuring the business can run without them to make it easier and more valuable to sell later.

How To Leverage Your Negotiating Power When Selling Your Business - Founders who sold shared that preparing early, understanding your company’s strategic value, and strengthening your pitch and finances can significantly improve negotiating leverage when selling your business.

EDUCATIONAL RESOURCES

Master Financial Modeling from Elite Practitioners

6 jam-packed courses with countless cases and 30+ exercises to help you learn financial modeling. Each course is designed to guide you step-by-step in your journey to develop elite modeling skills. Click Here!

FROM THE BENCHMARK BLOG

My firm, Benchmark International, a global, award-winning sell-side M&A company, has a ton of great resources that help anyone considering selling or buying a business get more educated on all aspects of the process. Below is just one helpful article. Check out Benchmark International for many more useful articles, news, and resources.

INDUSTRY ASSOCIATIONS

Trade Associations in the M&A Industry

LIGHTEN UP!

In the fast-paced world of M&A, we can sometimes take things (and ourselves) a bit too seriously, so it’s good to remember to enjoy a lighter moment now and then.

A BEAST of An Investment - $200M for MrBeast's DeFi Ambitions

M&A MERCH

Here’s a find for us finance folks to grab some M&A-inspired swag. Stuff for those of us that speak fluent EBITDA. If you find others that have great deal-themed gear, send them this way so we can let everyone know. Enjoy!

Thanks for reading this week's edition!

Share the M&A Mindset with colleagues who'd benefit from straightforward M&A insights.

Got a topic you want covered or feedback to share? Just hit reply—I read everything.

Stay Curious,

Derek Avdul

New to the M&A Mindset? This weekly newsletter cuts through the noise with concise insights, infographics, and resources on middle-market M&A—trusted by 5,000+ deal professionals, business owners, and investors. Whether you're planning a transaction, building your expertise, or just fascinated by deals, you'll find something valuable here every week.

Questions or suggestions? [email protected]

Reply