- M&A Mindset

- Posts

- Where Deals Break: Timing Risk Across The M&A Process

Where Deals Break: Timing Risk Across The M&A Process

Plus: The Myth of The Perfect Exit

Quick M&A Insights, Infographics, & Interesting Info Every Week!

Welcome to the M&A Mindset!

This Week:

We're breaking down where deals can break down. Plus, we look at the why there is no such thing as the perfect deal - there are always trade-offs. And, as always, curated articles, learning resources, fun M&A merch, and something to get you to lighten up a bit...

Let's dive in.

- Derek

Table of Contents

INTERESTING INFOGRAPHIC

Each week, I feature a visually engaging infographic that distills a key M&A subject area into an easy-to-digest format. These quick reference guides aim to deliver clarity, insight, and practical understanding at a glance.

Where Deals Break: Timing Risk Across The M&A Process

M&A TOPIC BRIEFING

In this section, I provide a clear, concise overview of a specific topic, trend, or concept within the realm of M&A. The goal is to educate, inform, and spark discussions on relevant subjects, helping you deepen your knowledge and better navigate the complexities of M&A more confidently.

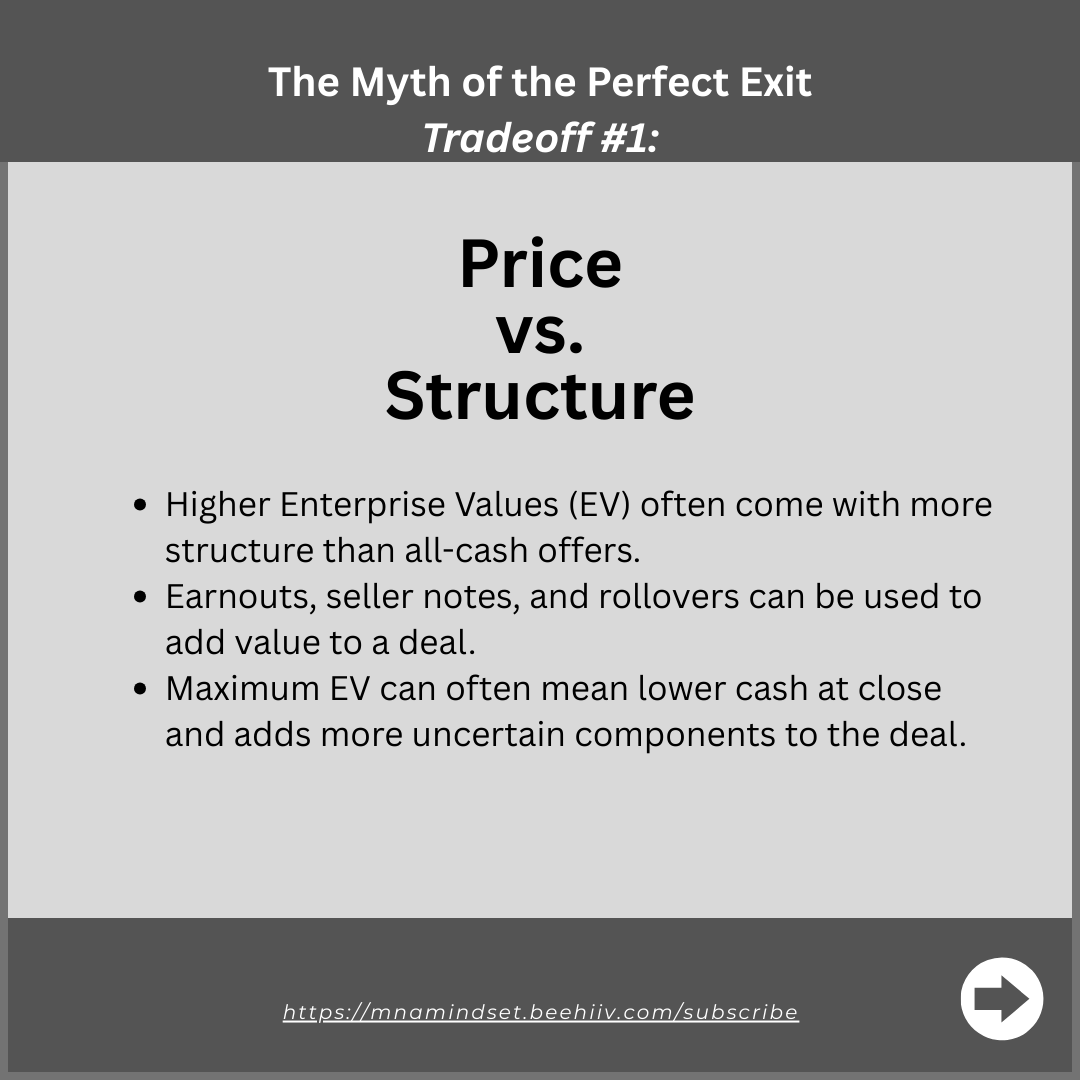

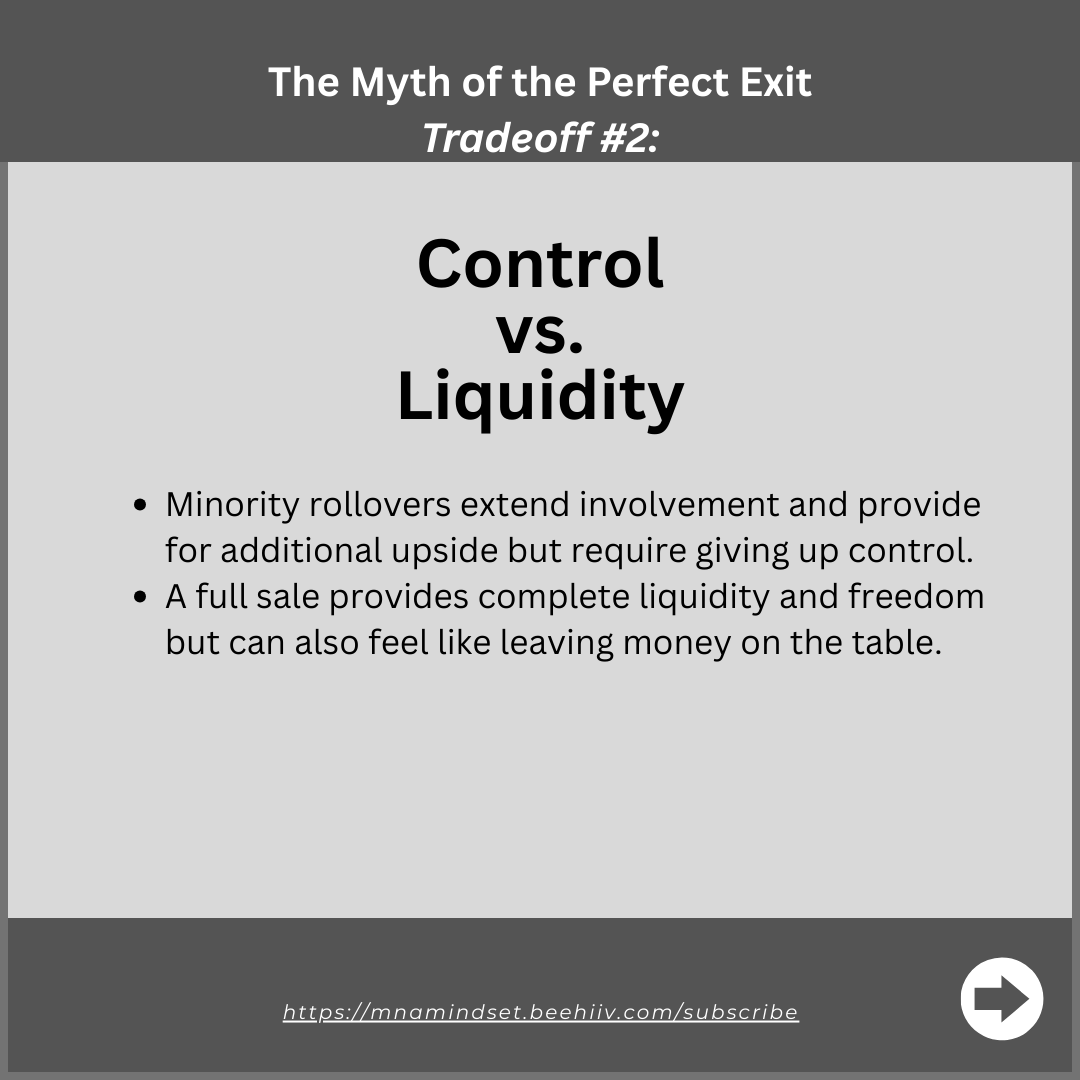

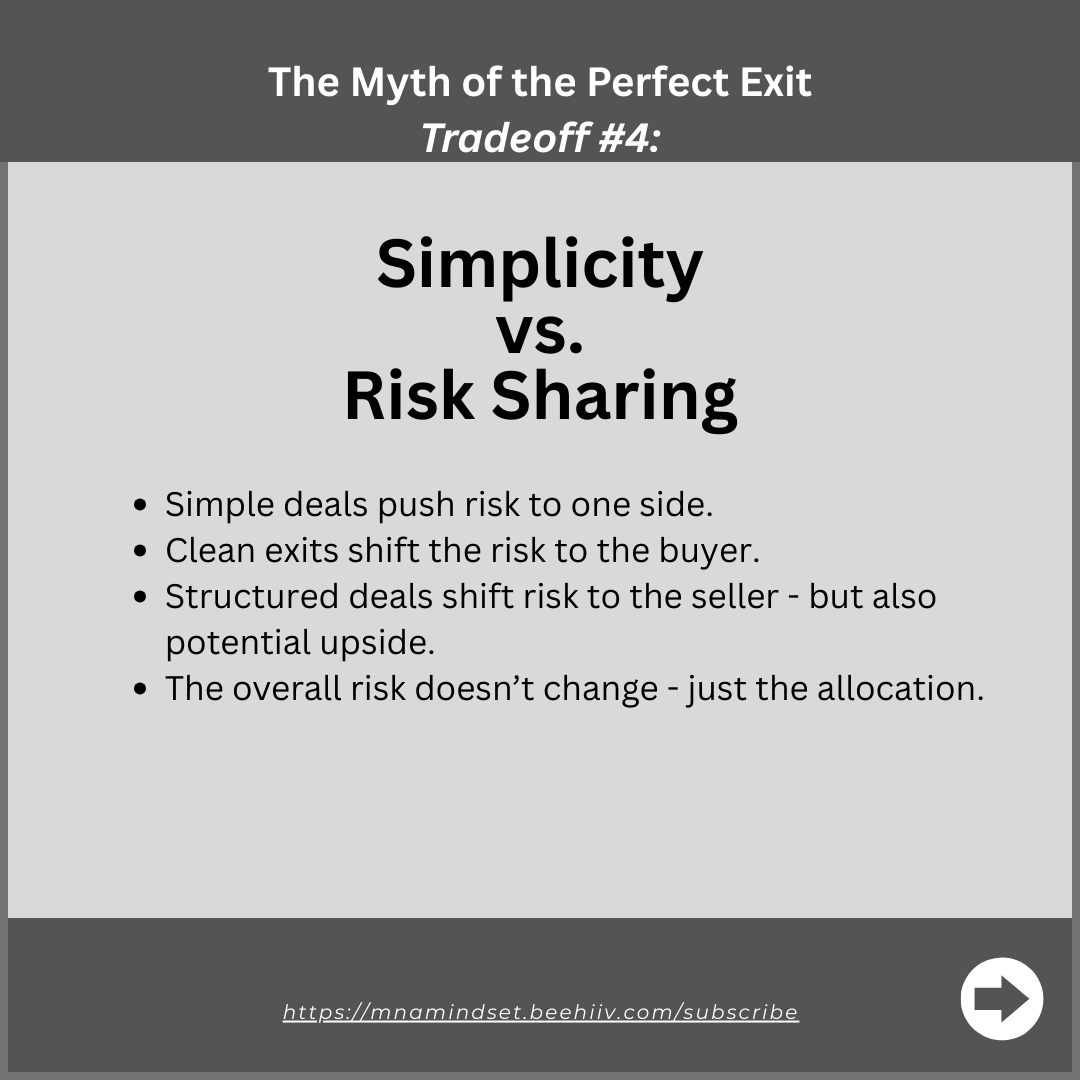

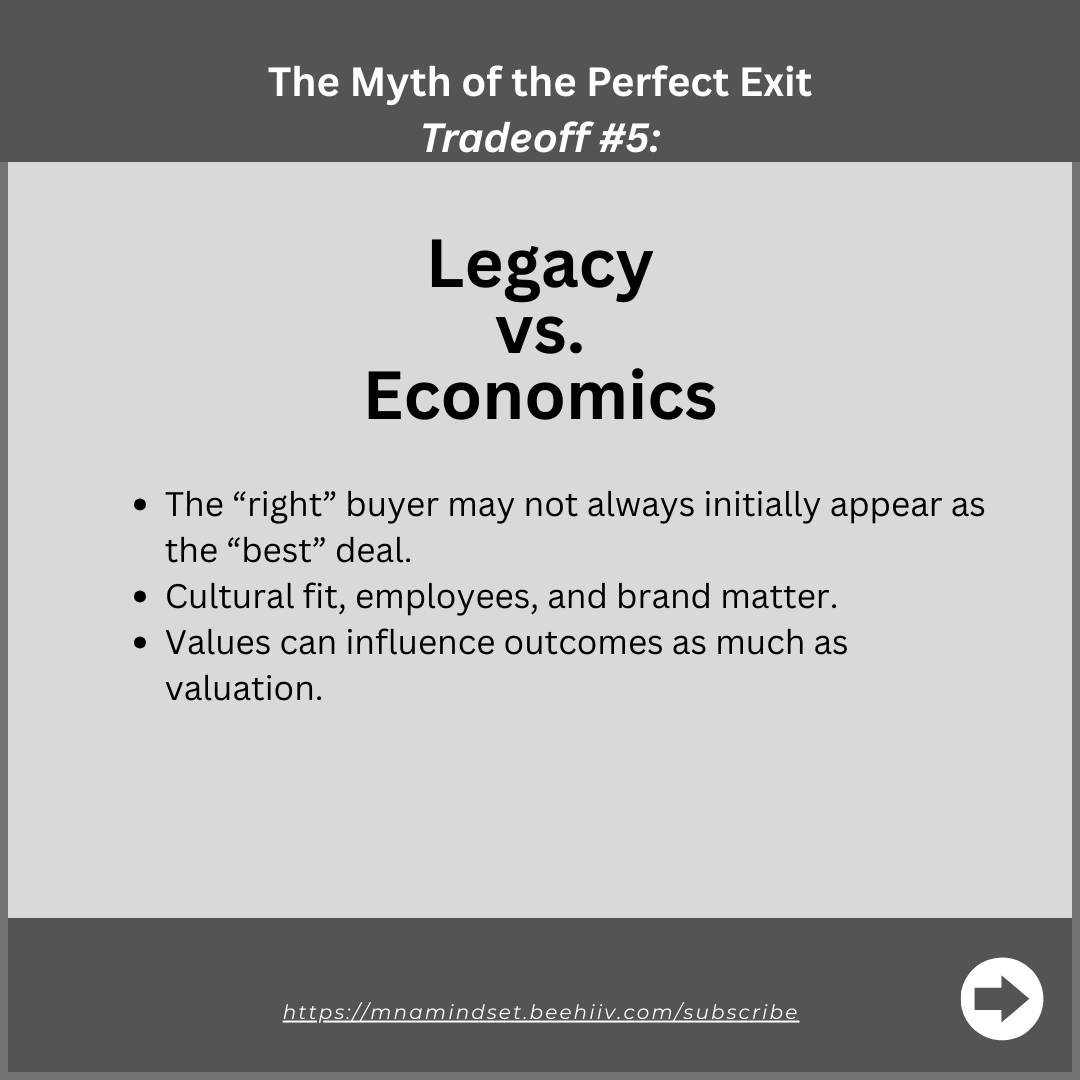

The Myth of The Perfect Exit

All the news that matters to your career & life

Hyper-relevant news. Bite-sized stories. Written with personality. And games that’ll keep you coming back.

Morning Brew is the go-to newsletter for anyone who wants to stay on top of the world’s most pressing stories — in a quick, witty, and actually enjoyable way. If it impacts your career or life, you can bet it’s covered in the Brew — with a few puns sprinkled in to keep things interesting.

Join over 4 million people who read Morning Brew every day, and start your mornings with the news that matters most — minus the boring stuff.

ARTICLES OF INTEREST

The Forces Shaping M&A in 2026 - M&A in 2026 will be shaped by improving financing conditions, ongoing geopolitical complexity, and rapid adoption of AI — especially agentic AI across deal sourcing, diligence, and integration.

The Trends Shaping Cross-Border M&A in 2026 - Cross-border M&A in 2026 is expected to be shaped by megatrends such as an increase in corporate carve-outs, geopolitical and state capital influences, and strategic shifts toward localized supply chains and joint ventures.

Lower Middle-Market M&A: 5 Predictions for Private Equity Buyers in 2026 - Private equity activity in the lower middle market in 2026 is expected to be driven by add-on acquisitions, improved (but disciplined) credit conditions, and continued valuation focus on quality assets, while smarter deal structures and rising competition from independent sponsors shape buyer strategies.

4 Practical Ways Small Businesses Can Leverage AI - AI can help SMBs boost productivity, improve decision-making, and automate routine tasks, but success depends on choosing the right tools, upskilling teams, and aligning AI use with business goals.

Small Businesses Plan a Hiring Jump in 2026 - Small businesses are planning to increase hiring in 2026, reflecting optimism about growth prospects and the need to expand teams to meet demand.

EDUCATIONAL RESOURCES

Master Financial Modeling from Elite Practitioners

6 jam-packed courses with countless cases and 30+ exercises to help you learn financial modeling. Each course is designed to guide you step-by-step in your journey to develop elite modeling skills. Click Here!

FROM THE BENCHMARK BLOG

My firm, Benchmark International, a global, award-winning sell-side M&A company, has a ton of great resources that help anyone considering selling or buying a business get more educated on all aspects of the process. Below is just one helpful article. Check out Benchmark International for many more useful articles, news, and resources.

INDUSTRY ASSOCIATIONS

Trade Associations in the M&A Industry

LIGHTEN UP!

In the fast-paced world of M&A, we can sometimes take things (and ourselves) a bit too seriously, so it’s good to remember to enjoy a lighter moment now and then.

It's That Time Again...Blackstone's 2025 Holiday Video

M&A MERCH

Here’s a find for us finance folks to grab some M&A-inspired swag. Stuff for those of us that speak fluent EBITDA. If you find others that have great deal-themed gear, send them this way so we can let everyone know. Enjoy!

Thanks for reading this week's edition!

Share the M&A Mindset with colleagues who'd benefit from straightforward M&A insights.

Got a topic you want covered or feedback to share? Just hit reply—I read everything.

Stay Curious,

Derek Avdul

New to the M&A Mindset? This weekly newsletter cuts through the noise with concise insights, infographics, and resources on middle-market M&A—trusted by 4,000+ deal professionals, business owners, and investors. Whether you're planning a transaction, building your expertise, or just fascinated by deals, you'll find something valuable here every week.

Questions or suggestions? [email protected]

Reply